I owe you all a deeper explanation of my NFT valuation modeling project, and some longer thoughts on the “blue chip” NFT space. For now though, here’s a short piece on something newsy and relevant.

Last week, anon collector 0x650d announced that he’ll be selling his lot of 104 “floor Punks” through Sotheby’s — on short notice. After a few words of background (feel free to skip ahead) we’ll show how we value this collection — and what price this “bag” might fetch since its assembly in July, 2021.

Act One: Choose Wealth

In late July 2021, anon 0x650d used a bot to “sweep the floor” of CryptoPunk, buying up the cheapest Punks on the market, over a number of days.

You can see the 104 Punks here, still in the same wallet (minus the last two bought later). As you can see, he paid 23-29 ETH per Punk. https://www.larvalabs.com/cryptopunks/accountinfo?account=0x650dcdeb6ecf05ae3caf30a70966e2f395d5e9e5

The thread as to how and why he bought 100+ floors is worth reading. Here’s a relevant excerpt in case it this deleted.

Ox650d’s thesis has partly borne out. Floor Punks have out-performed rare items, and liquidity at the floor has been pretty good, especially if you’re willing to take a week or two to sell.

Act Two: Up, Down and Sideways

There’s no sugarcoating it, Punks values peaked in October 2021. The floor crossed 100 ETH, and have been sliding down since early November. Stable, perhaps since December — in ETH terms — but not approaching those 100 ETH floors since.

You can see this graph of “All Punks” on DeepNFTValue.

Here we show a few time series, for Punk prices and transactions since June 2021:

Red dots represent randomly sampled Punk sales (we manually hid sales above 300 ETH to make the graph more viewable)

The dotted line shows the daily “floor” — minimum offer for the cheapest Punk

The blue lines show 10%/50%/90% lines for our value estimates

Punk sales, floor prices and our 10%/50% value estimates track each other pretty closely. In general, most Punks are valued within 20% of the floor value, although the actual floor changes every day, as it depends on an individual owner’s listing.

Note the flurries of activity:

Late August and early September — as Punks floor went up ~3x

Sell-off in late December as Punks bottomed in ETH terms

Run-up in early January with multiple floor sweeps, although not at August/September levels of buying activity as you can see in the graph

Our anonymous friend bought in at a good time! By September his bags were worth 3x what he paid, and there looked to be insatiable demand for Punks. Any Punks.

I won’t get into all of the FUD and problems since then. Suffice it to say Punks lost a lot of their steam, especially after prices stopped rising, and as Bored Ape Yacht Club (BAYC) showed they were better at promoting a PFP project than Larva Labs.

The floor for Punks and Bored Apes “met” in late December in the 50s. Since then Punks are up a bit (and a 50s floor was a local minimum) but Apes floor is up 2x since then to ~100 ETH. There’s rumors of an $APE token…

Meanwhile, Ox650d fractionalized a portion of his collection. This meant if he wanted to reduce exposure, selling a few floor Punks into the market, he’d need to buy out fractional investors, as they had partial ownership of the whole lot.

Once he bought out fractional owners in early December 2021 for ~84 ETH/Punk, the smart money was on some form of wholesale liquidation.

Act Three: Back on the Market

Everyone who says they will never sell, 90% of the time they will sell, and often days after saying so.

Days after announcing he’d keep Punk Ape #4156 (probably forever), the head of Nouns DAO held a dutch auction for it, selling for 2,500 ETH as buyers scrambled to gather the funds on chain.

Similarly as Ox650d wrote in July about choosing wealth and riding the inevitable adoption of Punks as a historical NFT project, by early 2022 he was ready to move on.

What are his bags worth? And will he even make a profit on the initial purchase, after fees…

Valuation

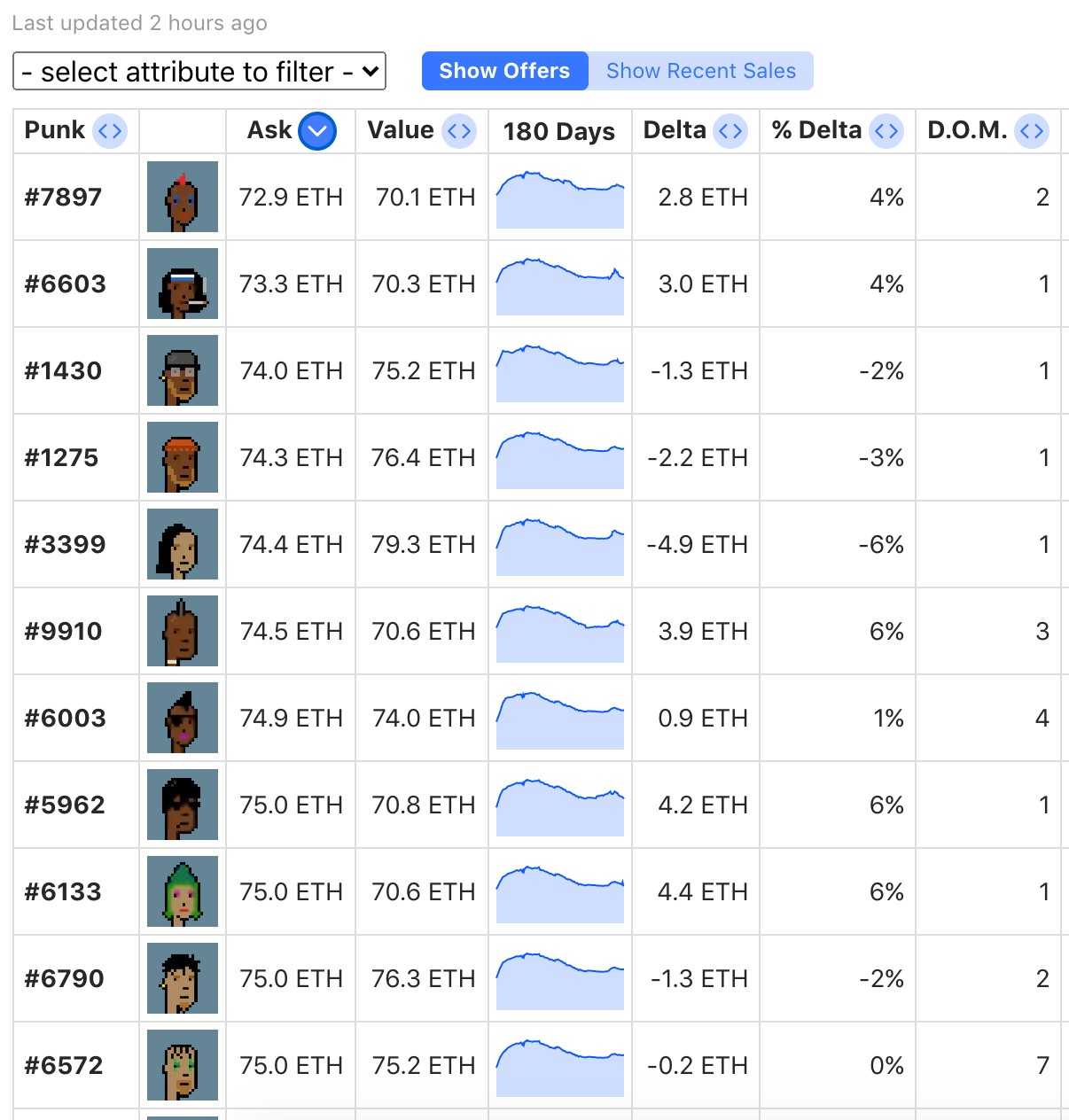

Applying our pricing model to the 104 Punks, we give you a vanity website for the Sotheby’s collection:

As of Feb 14th 2022, we see the collection as being worth 74.2 ETH per Punk. The individual items ranging from 83.2 ETH for Punk #2401 to 70.8 ETH for Punk #2822.

Punks are up from last week’s prices. Due perhaps to the 8,000 ETH Alien sale this weekend, and the positive Punks sentiment since then. The current Punks floor (lowest item on offer) is 72.9 ETH for Punk #7897.

Before the Alien sale, just a few days ago, Punk floors bottomed out around 65 ETH, and accepted bids dropped as low as 60-63 ETH. This market is not, exactly, super efficient.

Note that our valuation for this collection dips at 67 ETH, while individual items have sold as cheap as 52 ETH during the late December sell-off. Much of that is sellers desperate for liquidity. Perhaps. All I can say for sure is:

There is volatility in the market

Floors move every day, though tend to even out over time

The market impact of selling 104 Punks into the market, most of them floors, is totally unknown (but certainly bearish, albeit possibly priced in somewhat already)

What will these 👜 sell for?

Private polling I conducted right after news of the Sotheby’s auction dropped (before the Alien sale), suggested a consensus price of ~42-55 ETH per Punk. Maybe as high as 60 ETH…

There was some confusion about fees and taxes. I don’t know what those might be exactly, but for the bid we’re talking about the full “all-in” price, fees included.

I’ve heard that for lots this size ($10-$20M USD), most of Sotheby’s 18% fee gets kicked back to the seller. But I don’t really know how that works. I also assume even if there is a reserve price, it’s pretty low. It seem that even for a low 40’s ETH sale, Ox650d should be able to print somewhat of a profit, depending on how much of the 18% fee he gets back, and on what percent he had to buy out the Fractional collectors for, at 84 ETH/Punk — which he’s certainly not going to recoup from this sale. [His cost basis for the initial purchases in July 2021 was ~25 ETH/Punk, see above.]

A few numbers to consider:

Taking our fair value estimates at face value, 74.2 ETH/Punk = 7,720.2 ETH total ≈ $22.2M USD for the collection.

Bidding 60.0 ETH/Punk (after fees) = 6,240 ETH ≈ $18.0M USD

Low bid 42.0 ETH/Punk (after fees) = 4,368 ETH ≈ $12.7M USD

That’s a lot of USD to post, even if you’re buying “below the market.”

Moreover, despite what Sotheby’s headline says, the buyer isn’t getting a once in a lifetime asset. Instead they are getting 104 of the least desirable items in a historic collection — that’s been down and sideways since October.

Before I FUD these bags too much, though, worth noting that:

~20% discount on net present value (in the case of the 60 ETH bid) is quite the premium

Dumping 104 floors on the market will tank Punks prices, but putting a few out there right now would easily sell for 70-72 ETH each

A few of the 104 Punks aren’t true floors, both commanding higher values, and not saturating the market for true floor Punks (those used for speculation, and unlikely to serve as anyone’s PFP)

NFTs demand is more closely tied to memes and market sentiment, than pure supply and demand

In other words, the bull case for buying the collection for up to 55-60 ETH per Punk allin:

Sell a few Punks a week, realizing 5-20 (!) ETH per Punk on cost basis

Commit to holding the rest, for 6-12 months

Negotiate with block buyers, looking to “put NFTs on the balance sheet,” into index-tracking pools, back into a factionalized pool, etc

Once you’ve sold ~1/2 of the collection above cost basis, you’ve got a great asset left to hold onto or to sell as a smaller lot

There’s skewed upside to holding Punks longer term (Ox650d’s original thesis)

The bear case is simply that $15-$18M is a lot of money. Everything in this market is pre-funded, so to speak. There’s less painful ways to make ~20% on your capital, and you’re going to have to pay people and fees to liquidate the collection for good prices.

I doubt that anyone really wants to hold on to this collection. The value would be, pretty clearly IMO, in un-bundling this set.

“only two ways to make money in business: One is to bundle; the other is unbundle.” — Jim Barksdale, as oft told by Marc Andreessen